Annual Review: Flourishing Nationwide! More Than 70 Key Laser Projects Rolled Out One After Another

source:Laserfair.com

keywords:

Time:2026-01-22

Source: Laserfair.com 8th Jan 2026

In 2025, China’s laser industry embraced a new wave of investment and expansion.

From the manufacturing heartland in South China to the high-end manufacturing clusters in the Yangtze River Delta, from the Optics Valley of China in Central China to the emerging industrial bases in the west, a series of major laser projects were successively signed, capped off and put into production.

These projects cover the entire industrial chain, ranging from core materials and key components to high-end equipment. They include not only key breakthroughs in localized substitution, but also technological layouts targeting cutting-edge applications such as new energy and intelligent vehicles.

01

Flourishing on Multiple Fronts:

A Frenzy of Over 70 Major Laser Projects

In 2025, China’s laser industry maintained an all-round, multi-level development momentum, with a constant stream of projects reaching groundbreaking, commissioning and capping milestones, injecting sustained vitality into the industry’s growth.

According to incomplete statistics, more than 70 major laser-related projects nationwide achieved key progress within the year, presenting a pattern of coordinated development across east-west and north-south regions. These projects covered major industrial clusters including the Yangtze River Delta, Pearl River Delta, Central China, North China and Western China, spanning the entire industrial chain of lasers, chips, equipment and materials.

Among them, over 10 projects boasted a total investment exceeding 1 billion yuan each. Examples include: the Phase II Project of Han’s Laser East China Headquarters base with a total investment of 10 billion yuan; the High-performance Special Optical Fiber Production base Project of Changjin Photonics with an investment of 1.5 billion yuan; and the Shandong Laser Industrial Park Project of Lead Intelligent with a total investment of 1.2 billion yuan.

In terms of project types, these developments included both basic material and core component projects that filled domestic gaps, such as Changjin Photonics’ High-performance Special Optical Fiber Production base, and high-end equipment manufacturing projects targeting downstream applications, such as Yifi Laser’s Headquarters base for Lithium Battery Laser Intelligent Manufacturing Equipment.

02

South China:

A New Engine for Innovation and Intelligent Manufacturing

South China, especially the Guangdong-Hong Kong-Macao Greater Bay Area, is emerging as a global innovation hub for the laser industry.

Over the year, several key projects reached major milestones: the Dongguan GBOS Laser Headquarters, with an investment of 300 million yuan, was topped out; the Shenzhen Appotronics Corporation Headquarters Building was put into use; the first building of the Guangdong Laser Plasma Industrial Park was capped off; and the Dongguan Glorystar Laser Headquarters, with a total investment of 358 million yuan, broke ground...

Notably, in November 2025, three leading laser enterprises simultaneously deepened their layout in South China, marking a three-pronged launch: DNE Laser Foshan Intelligent Manufacturing base, a subsidiary of Switzerland’s Bystronic Group, was inaugurated on November 12, 2025, with a total investment of 500 million yuan and an expected annual output value exceeding 1 billion yuan; the Aurora Laser Shaoguan base announced full-scale production on November 5, 2025, with an anticipated annual output value of 370 million yuan upon reaching full capacity; Longxin Laser, for its part, set up service centers in eastern Guangdong and Zhongshan in 2025, effectively covering the west bank of the Pearl River Delta and eastern Guangdong regions.

It is worth mentioning that the headquarters economy and R&D capabilities are accelerating their convergence in core cities of South China. On December 10, the JPT Greater Bay Area Laser Valley Tower was topped out in the core area of Shenzhen’s Lu Lake. With a designed height of 119.55 meters, this headquarters building is built to undertake the company’s global management functions and R&D missions for its "Light + AI" strategy. Meanwhile, Bodor Laser South China Headquarters base settled in Shenzhen; integrating intelligent manufacturing, R&D, services and exhibition, the base covers a construction area of over 20,000 square meters and is expected to achieve an annual production capacity of 5,000 units upon completion. In addition, the Shenzhen Appotronics Headquarters Building, put into use on March 11, is more than just a landmark—it is also a symbol of synergizing with the Pingshan Intelligent Manufacturing base to consolidate the company’s position in the industrial chain.

03

East China:

Industrial Synergy and High-End Manufacturing

Benefiting from its solid industrial foundation and complete industrial chain, the Yangtze River Delta region has become the top choice for laser enterprises to establish their East China regional headquarters and high-end manufacturing bases.

Among them, Han’s Laser made a heavy investment. On September 30, the Phase II Project of Han’s Laser East China Regional Headquarters base, with a total investment of 10 billion yuan, officially broke ground in Zhangjiagang, which will further enhance its production capacity in the field of high-end intelligent equipment.

Moreover, Suzhou High-tech Zone has emerged as a fertile ground for industrial agglomeration. In March 2025, Han’s Semiconductor East China Headquarters and Huaray Laser East China Headquarters signed agreements and settled successively. Huaray Laser will set up its East China Headquarters in the high-tech zone to build an R&D and manufacturing base, focusing on the development of high-power, high-energy ultrafast lasers and other products. Upon its launch, Suzhou PhotonicX rolled out a 1.6T optical chip solution.

As for Wuxi, in July 2025, the Hongguang Optoelectronics Industrial base Project kicked off in Huishan District, Wuxi, with a total investment of 3.08 billion yuan. It aims to form a 10-billion-yuan-scale photon manufacturing industrial cluster through the "1 Innovation Center + 1 Fund" model.

Meanwhile, the Phase II Project of the Optoelectronics Industrial Park under construction in Nanjing Jiangbei New Area was fully pre-leased upon the start of construction. It is designed to create a seamless pathway for photon chips "from lab to production line".

As a core hub of China’s laser industry, the projects launched in the Yangtze River Delta in 2025 focused on high-end, precision and advanced technologies. For instance, the Hangzhou-Shaoxing Airport Economic Demonstration Zone in Zhejiang introduced Aowei Laser, which invested 1 billion yuan to build a vertically integrated photonics base; its narrow-linewidth lasers have broken overseas monopolies. The Zhejiang Optoelectronics Project in Hangzhou Fuchun Bay New City topped out ahead of schedule, with an expected annual output value of 800 million yuan, focusing on the localization of optoelectronic materials.

04

Central China:

Optics Valley Projects Leading the Way

As the cradle of laser technology in China, Central China has initially formed a laser industry Golden Triangle centered on Wuhan Optics Valley, with Ezhou Gedian and Huangshi Park as the two wings, building a 100-billion-yuan laser corridor running through Wuhan-Ezhou-Huangshi.

In Wuhan, the Optics Valley laser cluster witnessed a collective surge of project progress. On January 15, 2025, the main building of Lead Rare Materials’ High-end Compound Semiconductor Materials and Chip Industrialization base Project was topped out, aiming to fill the gap in upstream materials required for the optical communication and laser industries. On July 12, the High-performance Special Optical Fiber Production base and R&D Center Project of Changjin Photonics was capped off, with a total investment of 1.5 billion yuan. On July 29, Yifi Laser’s Headquarters base for Lithium Battery Laser Intelligent Manufacturing Equipment was topped out, with a total investment of approximately 500 million yuan, which will serve as the company’s operation headquarters and innovation platform. On October 30, Building 1 of Raycus Laser’s New Light Source Production and R&D base (Phase I) was topped out, with a total investment of 489.5 million yuan, designed to break through the development bottlenecks of special light sources. On December 3, Guangzhi Technology’s headquarters base was topped out in the East Lake Comprehensive Bonded Zone, with an expected annual production capacity of 80,000–100,000 laser devices upon commissioning...

Notably, the industrial spillover and regional synergy effects centered on Wuhan are accelerating.

In Huangshi, the Huangshi Smart Laser Industrial Park, with a total investment of 5 billion yuan and a gross floor area of approximately 150,000 square meters, passed completion acceptance in January, aiming to become a first-class domestic and globally influential laser intelligent manufacturing industrial base.

In Ezhou, the Kebei Laser Intelligent Manufacturing base was completed on March 15, with an expected annual output value of 900 million yuan in the next three years. Meanwhile, Yifi Laser announced the signing of its Phase III project, and the Shanghai Qingfen Laser Cutting Head R&D and Production base (with a total investment of 120 million yuan) also settled successfully in the city.

In Xiangyang, the Yangtze Optical Fibre and Cable Optics Industrial Laser Industrial base was officially put into production on March 25. Jointly with enterprises such as Bodor Laser and Maxphotonics, it strives to build a regional laser industry cluster.

A laser industry corridor—with Wuhan Optics Valley as the core for R&D, design and headquarters functions, and surrounding cities undertaking manufacturing and industrialization—has taken shape, featuring well-defined division of labor and efficient coordination. This has greatly enhanced Hubei Province’s comprehensive competitiveness in the national and even global laser industry landscape.

05

Other Regions:

The Laser Industry Landscape Expands Further

Beyond the traditional advantageous regions, the layout of the laser industry expanded further nationwide in 2025, with landmark projects emerging in the western and northern regions of China.

In North China, Inspur Semiconductor Industrial Park in Jinan, Shandong, went into operation. With an investment of 600 million yuan, the park deployed the full-process production of laser chips, achieving an annual output of 60 million devices and boosting the upgrading of Jinan’s new-generation information technology industry. The CharmRay Laser Intelligent Manufacturing base in Yantai was topped out, providing services for precision machining in the aerospace sector. The construction of Phase II of Xingfu Liancheng·International Laser Valley in Shijiazhuang, Hebei, picked up speed; with an investment of 3 billion yuan to build standardized workshops, the project aims to develop a new highland for the laser industry in northern China.

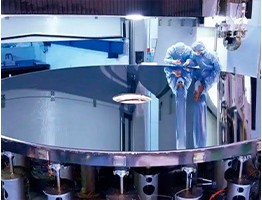

Image

In Southwest China, Hymson Laser made its strategic layout: the company’s Western Headquarters and Laser Intelligent Equipment Manufacturing base (Phase I) officially commenced operation and production, with a total investment of 1.2 billion yuan. The project will build a manufacturing base for laser intelligent equipment covering medical devices, lithium batteries, photovoltaics and other fields, and establish Hymson’s western operation center, R&D center and settlement center.

In Northwest China, Xi’an Lingsu Medical launched its laser medical equipment project with an investment of 200 million yuan, filling the gap in domestic high-end medical devices. In addition, the Allwave Qinhan Laser Device base in Xi’an Xixian New Area entered trial operation.

GBA High-Standard Summit Addresses Four AI+Laser Welding Core Propositions

GBA High-Standard Summit Addresses Four AI+Laser Welding Core Propositions Three Co-founders of a Leading Domestic LiDAR Maker Co-found a Robotics Firm

Three Co-founders of a Leading Domestic LiDAR Maker Co-found a Robotics Firm High-Efficiency Conversion Feeds R&D! Optoelectronic HOPE Model Builds a New Industrial Engine

High-Efficiency Conversion Feeds R&D! Optoelectronic HOPE Model Builds a New Industrial Engine Four-Meeting Linkage: China Laser CEO Shenzhen Night Shines Bright

Four-Meeting Linkage: China Laser CEO Shenzhen Night Shines Bright Lead the Intelligent Welding Revolution: Greater Bay Area AI + Laser Welding Summit

Lead the Intelligent Welding Revolution: Greater Bay Area AI + Laser Welding Summit

Father of Shenguang Facility: Building Three Generations of National Strategic Equipment

Father of Shenguang Facility: Building Three Generations of National Strategic Equipment LASERVALL's Li Mengmeng: A Leader in Laser Solder Ball Welding, Deep in Automated Niche Sectors

LASERVALL's Li Mengmeng: A Leader in Laser Solder Ball Welding, Deep in Automated Niche Sectors Intelligent Scientific Systems: Leading Domestic Ultrafast Imaging, Redefining Visual Perception

Intelligent Scientific Systems: Leading Domestic Ultrafast Imaging, Redefining Visual Perception From Rural Girl to Laser Helmsman: Fu Chunhua's Light-Chasing Journey

From Rural Girl to Laser Helmsman: Fu Chunhua's Light-Chasing Journey Scanner Optics: Galvanometer Tech Leader

more>>

Scanner Optics: Galvanometer Tech Leader

more>>