Three Deals in 30 Days: A Wave of Mergers and Acquisitions Hits the Laser Industry

source:Laserfair.com

keywords:

Time:2025-12-08

Source: Laserfair.com 4th Dec 2025

Winter has set in after the Start of Winter, and the first chill is in the air—but a merger and acquisition (M&A) frenzy is sweeping across China’s laser industry.

Recently, within a short span of 30 days, three major players—AFR, Shunke Taiding, and Sunshine Laser Technology—have made successive moves, investing a total of over 2 billion yuan. Through equity acquisitions, controlling-stake takeovers and other approaches, they have brought leading enterprises in niche sectors, including Agix, TETE Laser, and Lingxuan Precision, into their fold.

Among these deals, AFR spent 1.64 billion yuan to acquire Agix, a high-quality optical communication firm, targeting the surging demand for high-speed optical modules fueled by the AI computing boom. Shunke Taiding made a cross-sector foray to take control of TETE Laser, a seasoned industry player, marking its entry into the core arena of laser equipment manufacturing. For its part, Sunshine Laser Technology achieved a critical extension of its presence in the aerospace manufacturing chain by acquiring Lingxuan Precision.

These M&A activities cover not only core sectors such as optical communications, laser equipment, and aerospace but also reflect the industry’s strategic restructuring against the backdrop of the AI computing surge and accelerating localization. Behind this wave of mergers and acquisitions, the laser industry is ushering in a new round of resource integration and market reshuffle.

So, amid this upheaval that is reshaping the industry landscape, which players will stand out through resource integration and technological synergy to become the true leaders?

AFR

Acquires Agix for RMB 1.64 Billion to Strengthen Its Position in Optical Communications

According to news on November 26, 2025, AFR Technologies recently released a draft plan for a major asset restructuring. The company announced its intention to acquire a 99.97% equity stake in Suzhou Agix Optoelectronics Technology Co., Ltd. from five transaction counterparties including Zhang Guanming. The deal will be settled via a combination of share issuance, convertible corporate bonds, and cash payments, with the total transaction value set at RMB 1.64 billion.

As reported, Agix is a high-quality enterprise specializing in passive optical communication components, founded in 2009. Its core products are widely applied in 400G/800G optical modules and optical interconnection scenarios for AI data centers. Technologically, Agix has developed passive components tailored for the 1.6T optical communication market, boasting distinct advantages in production capacity and yield rate. In terms of clientele, it maintains in-depth cooperation with leading industry players such as Zhongji InnoLight .

Agix’s financial data shows that the company achieved operating revenue of RMB 509 million and a net profit attributable to shareholders of RMB 110 million in 2024. In the first half of 2025, it recorded operating revenue of RMB 321 million and a net profit attributable to shareholders of RMB 82.9955 million.

AFR Technologies stated that upon the completion of the transaction, it will integrate the respective strengths of both parties to achieve product complementarity and optimize production layout, thereby enhancing its global market competitiveness. As the only domestic enterprise that has mass-produced lithium niobate modulator chips, AFR Technologies is expected to lock in key links in the industrial chain through this acquisition and further consolidate its position in the industry.

Shunke Taiding

Takes Controlling Stake in TETE Laser to Expand Its Laser Equipment Footprint

On the evening of November 18, 2025, Shanghai Shunke Taiding Technology Co., Ltd. officially announced the completion of its acquisition of a 67.8% controlling stake in Shenzhen TETE Laser Technology Co., Ltd.

This move marks the successful entry of this information software service provider into the laser equipment manufacturing sector, achieving a significant expansion of its business footprint. Notably, following the completion of the transaction, 9 well-known institutional investors including Shenzhen Capital Group, Xiaomi Industrial Investment, and Fosun Capital will continue to hold minority stakes in TETE Laser, reflecting the original shareholders’ continued confidence in the company’s future development.

As the core target of this acquisition, Ted Laser boasts 24 years of industry experience. Since its establishment in 2001, the company has focused on the R&D and manufacturing of laser automation equipment, establishing a leading position in the consumer electronics sector. In recent years, its business scope has gradually expanded into emerging fields such as semiconductor packaging and testing, silicon carbide materials, and lithium battery new energy.

Public data shows that TETE Laser not only has an independent technology R&D and product development center, but also undertakes the national 863 Major Scientific and Technological Projects, with profound technical reserves. In its shareholder structure, Shenzhen Capital Group, as a representative of "patient capital" that has accompanied the company from its start-up to maturity, has stayed invested for 25 years, setting a benchmark example of Chinese private equity institutions supporting the growth of advanced manufacturing.

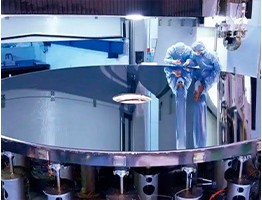

TETE Laser’s main products cover more than ten series, including precision laser cutting/drilling systems, 3D dynamic focusing laser marking systems, and IC dual-track fully automatic/semi-automatic laser marking systems. Among them, the DPF series of diode-pumped fiber laser marking systems and laser soldering systems have demonstrated outstanding performance in precision and stability, and have been widely applied in marking, welding and cutting processes across various industries. This comprehensive product portfolio enables it to meet the diverse processing needs of customers, forming a unique competitive edge in the market.

For Shunke Taiding, taking a controlling stake in TETE Laser is a key step in its layout of intelligent equipment manufacturing. Going forward, the two parties will join hands to accelerate technological iteration and expand the global market. While maintaining their advantages in the consumer electronics sector, they will further deepen their presence in high-growth fields such as semiconductors and new energy, creating stable and sustainable value for all stakeholders.

Sunshine Laser Technology

Acquires Lingxuan Precision to Extend Its Aerospace Manufacturing Industrial Chain

On the evening of October 27, 2025, Sunshine Laser Technology issued an announcement stating its intention to acquire a 36.47% equity stake in Chengdu Lingxuan Precision Machinery Co., Ltd. for RMB 241 million. Meanwhile, Han Dong, the former controlling shareholder of Lingxuan Precision, will entrust the voting rights of his remaining 35% equity stake to Sunshine Laser Technology. Upon completion of the transaction, Sunshine Laser Technology will collectively control 71.47% of the voting rights in Lingxuan Precision, thereby gaining actual control of the company.

This marks Sunshine Laser Technology’s second acquisition within the year. Back in July, the company acquired a 56% equity stake in Yilian Infinite for RMB 352 million, stepping into the field of communication equipment manufacturing.

The target of this acquisition—Lingxuan Precision—is a key manufacturer of precision components dedicated to the aerospace and weaponry sectors. Its main products cover four categories, including navigation warhead components, missile body assemblies, seeker assemblies, and aircraft carriers, making it one of the core suppliers for relevant military industrial units. The company holds leading technologies in the processing of titanium alloy thin-walled components and precision micro-holes, with a solid backlog of orders and outstanding profitability at present.

Financial data shows that Lingxuan Precision achieved an operating revenue of RMB 135 million and a net profit of RMB 36.1074 million in 2024. In the first half of 2025, it recorded an operating revenue of RMB 85.1968 million and a net profit of RMB 21.9999 million.

According to the valuation, the total equity value of Lingxuan Precision’s shareholders is RMB 664 million, representing a value appreciation rate of 485.96%, with an overall valuation of RMB 660 million for 100% of its equity. The counterparties to the transaction have made corresponding performance commitments: Lingxuan Precision’s non-recurring profit after tax (non-gaap net profit) for the years 2026 to 2028 shall not be less than RMB 55 million, RMB 70 million and RMB 88 million respectively. The cumulative committed net profit over the three years will reach RMB 213 million, with an average annual growth rate exceeding 20%.

Analysts believe that for Sunshine Laser Technology, this acquisition marks another step forward in its high-end manufacturing footprint. The company’s existing aerospace manufacturing business is mainly undertaken by its subsidiary Tongyu Aeronautical, whose products include CNC-machined aerospace components and additive manufacturing aerospace components. Following the acquisition of Lingxuan Precision, it will further expand the scale of its aerospace manufacturing segment, achieve critical extension of the industrial chain, and foster new growth drivers.

Behind the M&A Wave Accelerated Consolidation in the Laser Industry: Who Will Come Out on Top?

Within a short span of 30 days, three major M&A deals have unfolded in quick succession—starting with Sunshine Laser Technology’s pioneering move on October 27, followed by Shunke Taiding’s follow-up transaction on November 18, and capped off by AFR Technologies’ headline-grabbing acquisition on November 26. The pace of mergers and acquisitions has been notably intense.

The clustered completion of these three blockbuster deals in the laser industry is by no means accidental. Covering niche sectors ranging from optical communications and laser equipment to consumer electronics and military aerospace, these transactions are a testament to the ever-expanding boundaries of laser technology applications.

In fact, multiple driving forces have converged behind these acquisitions. The boom in AI computing power has directly fueled demand for high-speed optical communication devices, spurring AFR Technologies’ strategic acquisition of Agix. The ongoing advancement of 5G network construction has opened up vast space for laser equipment, prompting Shunke Taiding to set its sights on Ted Laser. Meanwhile, the accelerated modernization of national defense has created the impetus for Sunshine Laser Technology’s acquisition of Lingxuan Precision.

Furthermore, leading enterprises have demonstrated clear strategic intent throughout this round of M&A activity. Breaking free from the confines of standalone sectors, they are building integrated industrial chain ecosystems through horizontal expansion and vertical deepening. This diversification strategy not only mitigates risks but also captures more growth opportunities.

Looking ahead, as technological iteration speeds up and policy support intensifies, M&A consolidation in the laser industry is expected to advance further. Leading players armed with capital and technological advantages will continue to expand, while hidden champions in niche segments are likely to emerge as targets for the next wave of acquisitions.

GBA High-Standard Summit Addresses Four AI+Laser Welding Core Propositions

GBA High-Standard Summit Addresses Four AI+Laser Welding Core Propositions Three Co-founders of a Leading Domestic LiDAR Maker Co-found a Robotics Firm

Three Co-founders of a Leading Domestic LiDAR Maker Co-found a Robotics Firm High-Efficiency Conversion Feeds R&D! Optoelectronic HOPE Model Builds a New Industrial Engine

High-Efficiency Conversion Feeds R&D! Optoelectronic HOPE Model Builds a New Industrial Engine Four-Meeting Linkage: China Laser CEO Shenzhen Night Shines Bright

Four-Meeting Linkage: China Laser CEO Shenzhen Night Shines Bright Lead the Intelligent Welding Revolution: Greater Bay Area AI + Laser Welding Summit

Lead the Intelligent Welding Revolution: Greater Bay Area AI + Laser Welding Summit

Father of Shenguang Facility: Building Three Generations of National Strategic Equipment

Father of Shenguang Facility: Building Three Generations of National Strategic Equipment LASERVALL's Li Mengmeng: A Leader in Laser Solder Ball Welding, Deep in Automated Niche Sectors

LASERVALL's Li Mengmeng: A Leader in Laser Solder Ball Welding, Deep in Automated Niche Sectors Intelligent Scientific Systems: Leading Domestic Ultrafast Imaging, Redefining Visual Perception

Intelligent Scientific Systems: Leading Domestic Ultrafast Imaging, Redefining Visual Perception From Rural Girl to Laser Helmsman: Fu Chunhua's Light-Chasing Journey

From Rural Girl to Laser Helmsman: Fu Chunhua's Light-Chasing Journey Scanner Optics: Galvanometer Tech Leader

more>>

Scanner Optics: Galvanometer Tech Leader

more>>