2025 Laser Market Status Analysis: Global Laser Market Size to Approach USD 50 Billion

source:Chinabgao

keywords:

Time:2025-12-08

Source: Chinabgao 20th Nov 2025

In 2025, driven by the dual forces of the global economic and trade landscape and the upgrading of domestic high-end manufacturing, the laser industry is experiencing explosive growth. The export volume of core products has exceeded the 10-billion-yuan mark. Domestic laser technologies have not only achieved in-depth penetration in the industrial manufacturing saector, but also formed a synergistic growth effect across diverse scenarios such as new energy and medical care, emerging as a core pillar supporting high-end manufacturing. Below is an analysis of the 2025 laser market status.

1. Export of Core Laser Products: High-End Transformation with a 10-Billion-Yuan Scale

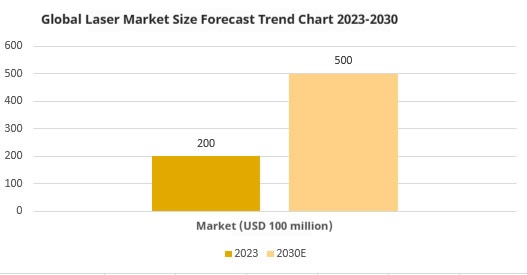

The expansion of export volume and optimization of product mix for laser products have become prominent features of the 2025 laser market, with the technological competitiveness of core product categories continuing to stand out. The global laser market size already exceeded USD 20 billion in 2023. According to the 2025-2030 China Laser Industry Market Research and Investment Prospect Analysis Report, it is projected to approach USD 50 billion by 2030, maintaining a compound annual growth rate (CAGR) of around 10%.

Export Scale and Product Category Contribution: In H1 2025, the export volume of laser-related products reached the 10-billion-yuan threshold. Among these, laser welding machines and devices topped the list with an export value of 12.67 billion yuan, followed by laser processing machine tools at 8.47 billion yuan and lasers (excluding laser diodes) at 5.99 billion yuan. High-value-added product categories delivered particularly outstanding performance: the export value of laser transceiver modules for optical communication equipment hit nearly 19.4 billion yuan, accounting for 45.6% of the total exports of all laser products; laser rangefinders achieved exports of 1.05 billion yuan with a shipment volume of nearly 11.75 million units.

Structural Upgrading and Value Enhancement: Laser processing equipment is undergoing a transformation from mid-to-low-end OEM manufacturing to high-end customized production. Laser processing machine tools (HS Code: 845611) accounted for 87.07% of the total export value of laser processing machine tools (HS Code: 8456), with an average unit price of 23,434 yuan—3–5 times higher than that of conventional processing machine tools. The industrial chain synergy effect is remarkable: despite a shipment volume of only 681 units, laser welding robots achieved an export value of 55.812 million yuan, equivalent to an average unit price of approximately 82,000 yuan, forming a complete export chain together with laser welding devices and lasers.

Regional Markets and Growth Drivers: Exports of laser processing machine tools to Southeast Asia and Europe surged by 28% and 35% respectively, which is highly consistent with the regional distribution of overseas orders for China’s high-end ships. The resilience of export growth stems from technological breakthroughs: domestically produced 100G/200G optical modules have taken global leadership in core performance indicators, driving the export growth rate of laser transceiver modules and other similar products to outpace the 9.2% average growth rate of high-tech products.

2. Laser Segment Applications: Multi-Scenario Explosion Driven by Demand

As a foundational industrial technology, laser technology continues to unleash its enabling role in downstream industries, fostering a virtuous cycle of technology-driven upgrading and export-fueled iteration. Technological breakthroughs and policy support have built a sound industrial ecosystem, propelling the steady expansion of China’s domestic laser market and accelerating the localization process. The upstream segment of the laser industry chain mainly consists of optical materials, optical components, precision machinery, CNC processing equipment, special power supplies, and related auxiliary materials. The midstream covers laser R&D and manufacturing enterprises. The downstream focuses on various laser processing equipment and end-use applications, which extensively span strategic sectors including consumer electronics manufacturing, new energy technology, additive manufacturing, PCB processing, semiconductor production, automotive industry, advanced material preparation, and scientific research experiments.

In-depth Integration with the Automotive Manufacturing Sector: In H1, China’s electric vehicle exports rose by 32%, with vehicle exports through the Shanghai port reaching 1.275 million units (accounting for 36.7% of the national total), maintaining an average annual growth rate of 58.4% since the 14th Five-Year Plan period. New energy vehicle battery case welding requires a precision of 0.1 mm. Domestically produced laser welding robots, boasting a 99.99% welding pass rate, have been mass-deployed in overseas factories, driving automotive custom-specific equipment to account for over 40% of the total export value of laser welding machines and devices.

Scenario Expansion in the New Energy Industry: Exports of photovoltaic products and lithium batteries soared by 185% and 204% respectively. Both industries rely heavily on laser technology in their core production processes: the localization rate of equipment such as photovoltaic cell cutting and lithium battery tab cutting has exceeded 80%. Approximately 30% of laser processing machine tools are used in photovoltaic and lithium battery production, forming a "main product + supporting technology" bundled export model. Laser maintenance equipment is also entering overseas markets alongside photovoltaic module exports.

Deepening Penetration into High-End Equipment Manufacturing: In H1, overseas orders for China’s high-end ships skyrocketed by 40%, capturing two-thirds of the global market share. The adoption of laser welding technology for the invar steel cargo tanks of LNG carriers has tripled production efficiency while controlling the leakage rate to below 0.001%. Exports of industrial robots surged by nearly 60%, and machine tool exports grew by 29%. Around 40% of laser rangefinders are used as supporting components for industrial robots and intelligent machine tools, enhancing the intelligent competitiveness of the equipment.

3. Laser Industry Ecosystem: Scale Expansion Driven by Technology and Policy

The market size of China’s domestic laser industry is projected to exceed 230 billion yuan in 2025, maintaining a compound annual growth rate (CAGR) in the range of 18%–20%. Among the segments, the industrial laser equipment market will reach 150 billion yuan, accounting for approximately 62% of the total industry scale, with new energy-related equipment accounting for an increased share of 35%. The medical and aesthetic laser equipment market is expected to hit 45 billion yuan, and the penetration rate of household beauty devices will rise to 28%.

Technological Breakthroughs and Localization Progress: Fiber lasers still dominate the industrial sector, holding a market share of over 60%. Ultrafast lasers and semiconductor lasers are registering annual growth rates of 25% and 20% respectively. China has achieved breakthroughs in the core technologies of 10,000-watt-class fiber lasers; the market size of laser crystal materials will reach 8.5 billion yuan, and the localization rate target for high-power laser chips has been set at 90%. However, the high-power ultraviolet and ultrafast laser sectors still require further R&D efforts.

Policy Support and Industrial Layout: The 14th Five-Year Plan lists laser technology as a core equipment for intelligent manufacturing, setting a clear target of achieving a localization rate of over 85% for core components by 2025. Local governments have introduced a total of 23 special support policies. The Yangtze River Delta contributes 43.8% of the total industrial output value, followed by the Pearl River Delta at 29.5%. Central and western cities such as Wuhan and Chengdu have formed new industrial clusters, with leading enterprises occupying more than 30% of the market share through vertical integration.

The 2025 laser market is characterized by three distinct trends: high-end export orientation, diversified application scenarios, and industrial ecosystem integration. On the export front, the industry demonstrates international competitiveness through its 10-billion-yuan scale and structural upgrading. On the application front, it realizes two-way empowerment between demand and technology in sectors such as automotive and new energy. On the industrial front, it achieves scale breakthroughs supported by policies and technologies. From core components to system integration, and from domestic supporting to global supply, laser technology is emerging as the core engine of high-end manufacturing. With the release of demand in emerging fields, it will continue to write a new chapter of high-quality development in the future.

GBA High-Standard Summit Addresses Four AI+Laser Welding Core Propositions

GBA High-Standard Summit Addresses Four AI+Laser Welding Core Propositions Three Co-founders of a Leading Domestic LiDAR Maker Co-found a Robotics Firm

Three Co-founders of a Leading Domestic LiDAR Maker Co-found a Robotics Firm High-Efficiency Conversion Feeds R&D! Optoelectronic HOPE Model Builds a New Industrial Engine

High-Efficiency Conversion Feeds R&D! Optoelectronic HOPE Model Builds a New Industrial Engine Four-Meeting Linkage: China Laser CEO Shenzhen Night Shines Bright

Four-Meeting Linkage: China Laser CEO Shenzhen Night Shines Bright Lead the Intelligent Welding Revolution: Greater Bay Area AI + Laser Welding Summit

Lead the Intelligent Welding Revolution: Greater Bay Area AI + Laser Welding Summit

Father of Shenguang Facility: Building Three Generations of National Strategic Equipment

Father of Shenguang Facility: Building Three Generations of National Strategic Equipment LASERVALL's Li Mengmeng: A Leader in Laser Solder Ball Welding, Deep in Automated Niche Sectors

LASERVALL's Li Mengmeng: A Leader in Laser Solder Ball Welding, Deep in Automated Niche Sectors Intelligent Scientific Systems: Leading Domestic Ultrafast Imaging, Redefining Visual Perception

Intelligent Scientific Systems: Leading Domestic Ultrafast Imaging, Redefining Visual Perception From Rural Girl to Laser Helmsman: Fu Chunhua's Light-Chasing Journey

From Rural Girl to Laser Helmsman: Fu Chunhua's Light-Chasing Journey Scanner Optics: Galvanometer Tech Leader

more>>

Scanner Optics: Galvanometer Tech Leader

more>>