November Laser Industry: 3 Consecutive Financings, Central & Industrial Capital in Niches

source:Laserfair.com

keywords:

Time:2025-11-20

Source: Laserfair.com 14th Nov 2025

In November, the domestic laser industry witnessed an intensive outburst of financing activities. Within just half a month, three enterprises—Qinghong Laser, Huirui Photoelectric, and Newlas Intelligent Technology—successively secured large-scale financings, covering three high-growth niche segments: perovskite photovoltaic equipment, industrial-grade metal additive manufacturing, and intelligent welding inspection. Leading institutions such as CRRC Capital, Huagong Venture Capital, and Dynamic Capital, together with local state-owned capital platforms, have jointly entered the fray, underscoring strong capital confidence in the localization of core laser technologies.

Perovskite Equipment Segment: Qinghong Laser Secures Nearly 100 Million Yuan Series B Financing Backed by Central Enterprise

Recently, Qinghong Laser, a national-level "Specialized, Refined, Differential, and Innovative Little Giant" enterprise, announced the completion of nearly 100 million yuan in Series B financing, led by CRRC Capital with participation from multiple institutions. As a leading enterprise in perovskite laser processing equipment, its core products cover the full P1-P6 laser processing procedures for perovskite batteries. Leveraging technological advantages such as 24-beam parallel processing, 30-second cycle time, and a 1200×2400mm large-format platform, the company has won bids for laser scribing projects in China's first GW-level perovskite pilot lines of BOE, CNNC Optoelectronics, and other major enterprises.

Funds from this round of financing will be mainly used for capacity expansion and R&D of next-generation picosecond lasers. As the core capital platform under CRRC Corporation Limited, investor CRRC Capital not only values the trillion-yuan market potential of perovskite photovoltaics through this layout, but also aims to improve the advanced manufacturing industrial chain layout with the "industry + capital" model as the core development driver. With the certified conversion efficiency of perovskite batteries exceeding 26.7%, leading domestic enterprises are accelerating the construction of mass production lines, and Qinghong Laser's equipment supply capacity already covers over 30% of the industry's capacity demand.

The cooperation between Qinghong Laser and CRRC Capital will achieve complementary advantages in technological innovation and industrial resources, which not only promotes the company's own development, but also accelerates the localization process of China's high-end laser equipment, injecting new momentum into the upgrading of the advanced manufacturing industry.

Laser metal Additive Manufacturing Segment: Huirui Photoelectric Secures Series D Financing Support

On November 13, Nanjing Huirui Photoelectric Technology Co., Ltd. completed its Series D financing, with investors including Nanjing Binjiang Dynamic Venture Capital Partnership (Limited Partnership) and Weifang Hangdong Aeronautics & Astronautics Investment Partnership (Limited Partnership).

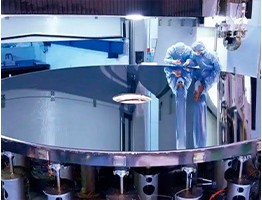

Founded in 2015, Huirui Optoelectronics is a national high-tech enterprise established by overseas high-level talents introduced under the national program. Adhering to the concepts of green manufacturing and intelligent manufacturing, the company is committed to the development of industrial-grade laser metal additive manufacturing technology, providing users with comprehensive solutions for high-performance metal component additive manufacturing equipment and technical services, including damage repair of metal components, surface strengthening, laser cleaning, laser welding, 3D printing forming of complex parts, and development of customized additive equipment.

Boasting leading industry technical strength, the company's independently developed complete sets of special laser metal additive manufacturing equipment have been successfully applied in the additive manufacturing of industrial products for large enterprises in energy and power, engineering machinery, mold manufacturing, rail transit and other fields. Its independently developed China's first set of mobile in-situ laser additive strengthening equipment for large hydropower equipment has successfully solved the repair problems of core components such as aero-engine high-pressure turbine blades and large water turbines, reducing equipment corrosion rate by 90% in application at a large hydropower station. The company's mastered high-precision eight-axis synchronous linkage control technology and self-developed coaxial powder feeding processing head can meet the needs of laser deposition manufacturing of complex structures, with related achievements winning the First Prize of Jiangsu Provincial Science and Technology Award.

On this basis, the company is also committed to the R&D and platform construction of digital manufacturing and intelligent manufacturing technologies. Huirui and its holding subsidiaries include multiple national high-tech enterprises, owning over 100 patents and software copyrights, ranking among the forefront of domestic peers.

Since its establishment, Huirui Optoelectronics has secured five rounds of financing in total. Funds from this round will be used for the R&D iteration of core technologies, capacity expansion, and market development to further consolidate its leading position in the laser additive manufacturing industry.

Intelligent Welding Inspection Segment: Newlas Secures Over 100 Million Yuan Series A Financing Backed by Industrial Capital Consortium

According to news on November 4, Wuhan Newlas Intelligent Technology completed over 100 million yuan in Series A financing. The round saw a follow-on investment from Huagong Venture Capital, with joint participation from industrial capital players including Inovance Industrial Investment, Yangtze River Industrial Investment, and Jiangcheng Fund, as well as provincial and municipal-level investment platforms.

The company focuses on the field of intelligent laser welding inspection. Its core product, the Oct Metrix intelligent weld penetration inspection system, has achieved three major breakthroughs: 10μm-level detection resolution, all-environment anti-interference capability, and an open architecture compatible with mainstream welding equipment. It has been mass-applied in the manufacturing of new energy vehicles' "three-electric systems" (battery, motor, electronic control).

Its technology has successfully addressed the industry pain points of traditional welding inspection, such as qualitative detection and high misjudgment rate. The missed detection rate of welding defects has approached zero, and production efficiency has increased by over 30%. Currently, the company has entered the supply chain of leading enterprises including CATL. Funds from this round of financing will be used to expand production capacity and extend the application scenarios of 3D dynamic welding inspection technology.

A person in charge of Huagong Venture Capital stated: "With the automotive, lithium battery and other industries attaching great importance to vehicle safety, cost reduction and efficiency improvement, the demand for manufacturing process upgrading continues to rise. High-end laser welding technologies such as in-process OCT welding inspection and laser flying welding are ushering in broad market space. Newlas's core team has over 20 years of technical accumulation in the field of laser welding processes and equipment, and possesses full-chain technical integration capabilities from process R&D, core components to complete machine systems. As a leading enterprise in the domestic substitution field, Newlas is gradually becoming a benchmark solution provider in laser welding control and inspection technology."

The company focuses on the field of intelligent laser welding inspection. Its core product, the Oct Metrix intelligent weld penetration inspection system, has achieved three major breakthroughs: 10μm-level detection resolution, all-environment anti-interference capability, and an open architecture compatible with mainstream welding equipment. It has been mass-applied in the manufacturing of new energy vehicles' "three-electric systems" (battery, motor, electronic control).

Its technology has successfully addressed the industry pain points of traditional welding inspection, such as qualitative detection and high misjudgment rate. The missed detection rate of welding defects has approached zero, and production efficiency has increased by over 30%. Currently, the company has entered the supply chain of leading enterprises including CATL. Funds from this round of financing will be used to expand production capacity and extend the application scenarios of 3D dynamic welding inspection technology.

A person in charge of Huagong Venture Capital stated: "With the automotive, lithium battery and other industries attaching great importance to vehicle safety, cost reduction and efficiency improvement, the demand for manufacturing process upgrading continues to rise. High-end laser welding technologies such as in-process OCT welding inspection and laser flying welding are ushering in broad market space. Xinnashi's core team has over 20 years of technical accumulation in the field of laser welding processes and equipment, and possesses full-chain technical integration capabilities from process R&D, core components to complete machine systems. As a leading enterprise in the domestic substitution field, Xinnashi is gradually becoming a benchmark solution provider in laser welding control and inspection technology."

Brief Comment: Technological Barriers and Scenario Implementation as Core Anchors

The November financing boom presents three prominent characteristics:

High focus on niche segments–perovskite equipment, laser metal additive manufacturing, and intelligent welding inspection are all high-end manufacturing fields strongly supported by the state, featuring high technical thresholds and rapid market growth;

Diversified and coordinated investor structure–central enterprises such as CRRC Capital layout strategic segments, industrial capital provides downstream scenario resources, and local state-owned capital platforms assist in technology industrialization, forming a joint force;

Technological independence as a hard indicator–all three enterprises have achieved independent control of core components and processes, breaking foreign technological monopolies and realizing domestic substitution in key areas.

With the continuous development of technology, the penetration rate of laser technology in new energy, semiconductors, high-end manufacturing and other fields will continue to rise. According to "Laserfair.com", the domestic laser equipment market scale is expected to exceed 200 billion yuan by 2026, and enterprises with core technologies and large-scale application capabilities will become the focus of continuous capital investment.

GBA High-Standard Summit Addresses Four AI+Laser Welding Core Propositions

GBA High-Standard Summit Addresses Four AI+Laser Welding Core Propositions Three Co-founders of a Leading Domestic LiDAR Maker Co-found a Robotics Firm

Three Co-founders of a Leading Domestic LiDAR Maker Co-found a Robotics Firm High-Efficiency Conversion Feeds R&D! Optoelectronic HOPE Model Builds a New Industrial Engine

High-Efficiency Conversion Feeds R&D! Optoelectronic HOPE Model Builds a New Industrial Engine Four-Meeting Linkage: China Laser CEO Shenzhen Night Shines Bright

Four-Meeting Linkage: China Laser CEO Shenzhen Night Shines Bright Lead the Intelligent Welding Revolution: Greater Bay Area AI + Laser Welding Summit

Lead the Intelligent Welding Revolution: Greater Bay Area AI + Laser Welding Summit

Father of Shenguang Facility: Building Three Generations of National Strategic Equipment

Father of Shenguang Facility: Building Three Generations of National Strategic Equipment LASERVALL's Li Mengmeng: A Leader in Laser Solder Ball Welding, Deep in Automated Niche Sectors

LASERVALL's Li Mengmeng: A Leader in Laser Solder Ball Welding, Deep in Automated Niche Sectors Intelligent Scientific Systems: Leading Domestic Ultrafast Imaging, Redefining Visual Perception

Intelligent Scientific Systems: Leading Domestic Ultrafast Imaging, Redefining Visual Perception From Rural Girl to Laser Helmsman: Fu Chunhua's Light-Chasing Journey

From Rural Girl to Laser Helmsman: Fu Chunhua's Light-Chasing Journey Scanner Optics: Galvanometer Tech Leader

more>>

Scanner Optics: Galvanometer Tech Leader

more>>