Global LiDAR Giants Engage in Escalating Patent Wars

source:China Business News

keywords:

Time:2025-11-04

Source: China Business News 29th Oct 2025

On October 28, a major intellectual property dispute erupted in the LiDAR industry: Hesai Technology, the world's first LiDAR company to achieve an annual production capacity of one million units, officially filed a lawsuit against peer firm Seyond for patent infringement on the same day. The Intermediate People's Court of Ningbo City, Zhejiang Province has accepted the case, with the core of the dispute centering on the technical similarities between Seyond's new product Robin E1X, unveiled at CES 2025, and Hesai's AT series products.

Allegations of infringement focus on three core suspicions

According to a source close to Hesai Technology, the rights protection effort is based primarily on three pieces of evidence: first, Robin E1X is strikingly similar to Hesai’s ATX product (launched in April 2024) in terms of appearance and interface design; second, Seyond has abandoned its long-standing "1550nm wavelength + 2D scanning" technical route, and adopted the identical "905nm wavelength + 1D scanning" architecture as Hesai’s AT series for Robin E1X; third, several former Hesai employees in North America—including a director-level staff member—have recently joined Seyond, raising suspicions of potential transfer of technical information.

In the lawsuit, Hesai Technology explicitly demands that Seyond immediately cease infringing on its multiple invention patents and utility model patents.

Core parameters of the involved products face off directly

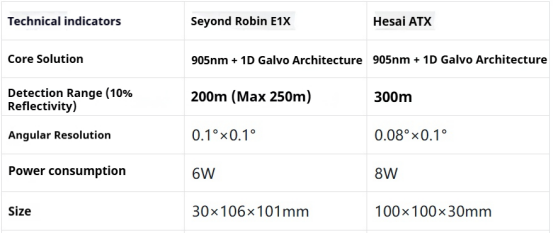

As core products in both companies’ market strategies, the high degree of overlap in the technical paths of Robin E1X and ATX has sparked widespread discussion in the industry. Below is a comparison of their key parameters:

Notably, as Seyond’s first mass-produced 905nm model, Robin E1X has achieved significant breakthroughs compared to its previous 1550nm products, with advantages such as 6W low power consumption and RMB 3,600 cost control—technical features that closely align with the core competitiveness of Hesai’s AT series.

Underlying implications of the lawsuit amid shifting industry dynamics

This dispute comes at a critical juncture marked by the LiDAR market boom and technical route evolution. Data shows that over the past three years, 905nm LiDAR has seen rapid market expansion due to cost advantages, while Seyond’s long-promoted 1550nm route has struggled to gain traction. Against this backdrop, Robin E1X is viewed as Seyond’s strategic product to enter the mainstream market, with plans for mass production in 2026 targeting hundreds of thousands of annual sales. It has already secured large-scale delivery validation from automakers like NIO.

In contrast, Hesai’s AT series has pioneered the "thousand-yuan era" (affordable pricing). By the end of September 2025, it had rolled out its 1 millionth LiDAR, with a planned annual capacity of 2 million units, cementing its first-mover advantage in the mid-range market. Industry analysts suggest the lawsuit could impact Seyond’s Hong Kong listing process—it just obtained CSRC approval for overseas listing on October 14 and aims to list on the Hong Kong Stock Exchange via a SPAC merger.

Four-Meeting Linkage: China Laser CEO Shenzhen Night Shines Bright

Four-Meeting Linkage: China Laser CEO Shenzhen Night Shines Bright Lead the Intelligent Welding Revolution: Greater Bay Area AI + Laser Welding Summit

Lead the Intelligent Welding Revolution: Greater Bay Area AI + Laser Welding Summit Splashing 200 Million Yuan! Three Industry Giants Boost Investment in the Laser Track

Splashing 200 Million Yuan! Three Industry Giants Boost Investment in the Laser Track Two New Companies Established! Han's Ecosystem Further Expands

Two New Companies Established! Han's Ecosystem Further Expands Multi-Sector Flourish! Five Major Laser Parks Rise Rapidly

Multi-Sector Flourish! Five Major Laser Parks Rise Rapidly

Intelligent Scientific Systems: Leading Domestic Ultrafast Imaging, Redefining Visual Perception

Intelligent Scientific Systems: Leading Domestic Ultrafast Imaging, Redefining Visual Perception From Rural Girl to Laser Helmsman: Fu Chunhua's Light-Chasing Journey

From Rural Girl to Laser Helmsman: Fu Chunhua's Light-Chasing Journey Scanner Optics: Galvanometer Tech Leader

Scanner Optics: Galvanometer Tech Leader The "Light Chasers" in the Deep Ultraviolet World

The "Light Chasers" in the Deep Ultraviolet World Shi Lei (Hipa Tech): Focus on Domestic Substitution, Future Layout in High-End Laser Micromachining

more>>

Shi Lei (Hipa Tech): Focus on Domestic Substitution, Future Layout in High-End Laser Micromachining

more>>