Global Laser Welding Mkt: Bright Outlook, CAGR Proj to Exceed 5% Next 5 Yrs

source:Yoyo (From Mordor Intelligence

keywords:

Time:2025-09-06

Source: Yoyo (From Mordor Intelligence) 12th August 2025

Currently, the global manufacturing landscape is undergoing a major transformation characterized by the deep integration of automation and digitalization, which has created broader development opportunities for advanced laser welding equipment technology. Industry data indicates that the global industrial automation market size is expected to grow from $244 billion in 2024 to $265 billion in 2025. The manufacturing sector's investment in digital tools is accelerating, with approximately 62% of enterprises planning to increase their investment in cloud computing over the next five years. This digital transformation is particularly evident in the field of production automation, where laser welding machines are playing an increasingly important role in achieving precise, efficient, and intelligent manufacturing processes. It is projected that the global laser welding machine market will achieve a compound annual growth rate of over 5% during the period from 2025 to 2030.

Figure 1. As an advanced, high-quality and efficient high-energy beam welding technology, laser welding has made remarkable achievements in industries such as automotive manufacturing, electrical/electronics, aerospace, metal products, and medical devices (Image source: Internet)

The electric vehicle (EV) revolution is reshaping manufacturing requirements and technological applications across various industries. It is projected that by 2030, Europe's battery production capacity will increase from 69 GWh in 2022 to 773 GWh, significantly boosting the demand for professional laser welding system solutions. Concurrently, green laser welding technology is evolving, offering a reduction of up to 20% in carbon dioxide emissions compared to traditional infrared systems.

Innovations in laser welding technology are revolutionizing advanced manufacturing processes, particularly in precision applications. For instance, in 2023, Scansonice, a German company, introduced the "High-Speed Collaborative Scanning Welding Mirror Group FCW". This high-speed collaborative galvanometer can help end users achieve rapid, efficient and precise welding processes. It features a wide scanning range, fast mirror movement and advanced quality monitoring functions, effectively enhancing manufacturing efficiency. The application of advanced technologies in the material processing industry is becoming increasingly widespread. According to statistics, the added value of the material product manufacturing industry has accounted for 3.982% of the global GDP.

The integration of intelligent manufacturing technologies is accelerating the in-depth application and development of laser welding technology in multiple fields. In February 2023, Newtec showcased its LASER FLOWPACK 700 industrial laser welding machine for ultra-thin film applications, highlighting the industry's progress towards more sustainable and efficient manufacturing methods. Meanwhile, the new generation of laser technology is also continuously expanding application possibilities: in June 2023, the American company NUBURU launched the next-generation pump laser diode, providing 65 W output power for industrial and consumer fiber lasers, an increase of about 30% compared to existing products, while maintaining a relatively low operating current requirement.

Figure 2. Laser welding technology is playing an increasingly important role in achieving precise, efficient and intelligent manufacturing processes. The picture shows the assessment of laser weld quality using intelligent process control technology. (Photo Credit: Fraunhofer ILT)

Market Trends of Laser Welding Machines

The scale of industrial automation is constantly expanding

The extensive adoption of industrial automation in manufacturing is driving up the demand for laser welding machines. The need of factories to enhance production efficiency, reduce human errors and stabilize welding quality has become the key driving force for the popularization of laser welding equipment. about 62% of enterprises plan to increase their spending on cloud computing in the next five years, and approximately 50% focus on artificial intelligence (AI), Internet of Things (IoT) and manufacturing automation tools.

The tight labor market and structural talent challenges are further driving the accelerated application of automation technology, and laser welding machine manufacturers are no exception. It is expected that by 2030, the population aged 50 and above in Europe will exceed 40%, making manufacturing enterprises increasingly rely on automation solutions to maintain production efficiency. The combination of demographic changes and the shortage of skilled welding talents has made automated laser welding systems an important investment for manufacturing plants. This technology can achieve high-precision and high-consistency operation with low human intervention, thus playing a key role in addressing labor challenges.

The rapid growth of manufacturing for electric vehicle power batteries

The rapid expansion of electric vehicle (EV) battery production capacity has greatly driven the market demand for laser welding machines. Laser welding technology has become an indispensable process in key production stages such as electrode lamination connection, tab welding, and battery casing sealing, providing precise and high-speed welding capabilities for battery packs, modules, and cells. Its green and environmentally friendly characteristics are highly consistent with the carbon reduction and energy efficiency goals of the EV manufacturing industry.

For instance, in June 2023, IPG introduced a new AMB tunable mode dual-beam laser specifically designed for high-performance processing of electric vehicles. It supports a maximum single-mode beam output of 3 kW and can achieve high-speed, spatter-free welding on key components in battery manufacturing, doubling the speed and significantly improving the welding quality. Another example is Coherent's SmartWeld+, a professional welding tool that adopts advanced beam shaping forms, including various swing modes. It can also precisely control the laser energy output during the welding process. As a result, the width, depth, and penetration profile of the weld seam can be meticulously managed. This is particularly suitable for welding heat-sensitive materials and dissimilar materials (such as copper and aluminum or steel). Moreover, this process can better weld highly reflective or volatile materials, effectively reducing spatter and cracks, and lowering porosity.

The innovative development of laser welding technology

Technological innovation has accelerated the optimization and application expansion of laser welding processes, especially with breakthroughs in high precision, high speed, and scalability. New wavelength and power arrangement designs have further expanded the application scope of laser welding. For instance, NLight's "Element" series of fiber lasers (with a single module capable of using 105 µm fiber for power supply and providing 90 W brightness output) demonstrates outstanding performance and batch processing adaptability. Similarly, NUBURU's new generation BL-1000-F blue laser, released in June 2023, has increased the output power from 250 W to 1000 W, significantly enhancing welding speed, micron-level precision, and repeat consistency, while reducing heat input. This is a key technological advancement for large-scale manufacturing scenarios such as EV battery module welding. Through continuous technological innovation, laser welding is constantly meeting the increasingly diverse demands for high controllability, high quality, and high efficiency welding solutions in the medical device, precision electronics, and micro-component manufacturing fields.

Manufacturing development

The transformation of the global manufacturing industry has brought broad application prospects to laser welding machine manufacturers, mainly due to the continuous demand for more flexible and efficient production methods. Data on manufacturing value added shows that different industries have made significant contributions, among which automotive products account for 1.144% of global manufacturing value added, consumer goods account for 2.944%, and industrial products and services account for 0.8888%. A diversified industrial system is accelerating the introduction of advanced manufacturing technologies, and laser welding is increasingly becoming a key driving force in modern manufacturing processes. Especially against the backdrop of the accelerated return of manufacturing, more and more enterprises are building new production bases in developed economies, and the demand for high-level automation solutions continues to grow to enhance their own competitiveness.

The development of the manufacturing industry is also reflected in the higher requirements for the precision of material connection and the continuous enhancement of the processing capabilities of new material combinations. Various factories are increasing their investment in digital tools and advanced manufacturing technologies to improve the visualization, transparency and overall operational efficiency of the production process. According to the "Industry Voice: Digitalization" survey report released by Euromonitor International, despite economic pressure, manufacturers' investment in digital tools is still accelerating, with cloud computing, artificial intelligence and the Internet of Things becoming key development directions. This digitalization process is highly compatible with laser welding technology, which can be seamlessly integrated into the intelligent manufacturing system to achieve real-time monitoring, quality control and process optimization of the welding process. With the continuous innovation of related technologies, the global welding equipment market is expected to enter a new growth cycle.

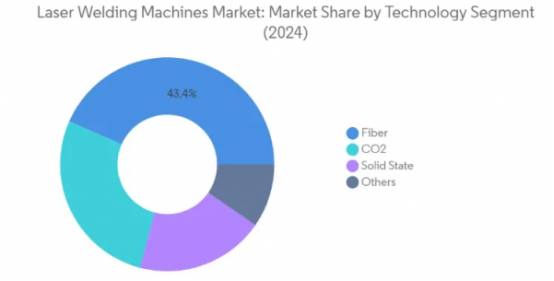

Market segmentation analysis based on technology categories

Fiber lasers: The core driving force in the laser welding market

Fiber lasers dominate the global laser welding machine market, with their market share expected to reach approximately 43% by 2024. This advantage stems from the wide application and profound influence of fiber laser technology across multiple industries. Its core strengths include long service life, low maintenance costs, high operational stability, and excellent cost performance, making it highly favored by manufacturing enterprises. As consumer demand continues to rise and price competition among manufacturers intensifies, the price of fiber laser sources has been steadily decreasing, making fiber laser cutting machines, welding equipment, and marking machines more economical and practical, significantly expanding the potential user base. Additionally, fiber lasers can transmit laser beams through flexible optical fibers, facilitating high-precision welding in complex geometries and hard-to-reach areas, a feature that further solidifies their market leadership position.

Figure 3. Market Share of Laser Welding Machines in Different Technology Fields (Photo Credit: Mordor Intelligence)

Solid-state lasers: A new growth engine for the laser welding market

The solid-state laser segment is projected to achieve the highest growth rate of approximately 7% during the forecast period from 2024 to 2029. This growth is mainly driven by continuous technological innovations, which have led to performance improvements, enhanced system reliability, and reduced operational costs. Solid-state lasers have demonstrated significant advantages in specific application areas such as automotive manufacturing and spot welding. By transmitting light beams through optical fibers rather than traditional mirrors, they offer superior beam quality and energy efficiency. Their core advantages include higher electro-optical conversion efficiency, lower energy consumption, and faster welding and cutting speeds. Compared to traditional industrial laser welding equipment, solid-state laser technology can significantly reduce the energy consumption of cooling systems and laser sources by up to 50%, making it increasingly favored by manufacturing enterprises that prioritize production efficiency and sustainable operations.

Other subfields of laser welding technology

CO₂ laser technology and other types of lasers still play a significant role in the laser welding equipment market. CO₂ lasers, with their high power output, are particularly suitable for cutting and welding tasks involving high-strength materials. Their excellent material adaptability and stable processing performance make them a reliable choice for many industrial applications. Meanwhile, emerging technologies such as semiconductor lasers are continuously expanding their application fields. With their unique advantages in high-precision welding requirements in electronics manufacturing and medical devices, they demonstrate broad development potential. These technologies, as important supplements to the market, enrich the application scope of products, meet the diverse and specialized needs of industrial processing, and build a more complete technical solution system.

Market segmentation analysis based on application fields

Automotive industry applications in the laser welding machine market

The automotive industry holds a dominant position in the laser welding machine market and is expected to contribute approximately 30% of the market share by 2024. This leading position stems from the extensive application of laser welding technology in various stages of automotive manufacturing, including the welding of white bodies and the production of electric vehicle batteries. Laser welding, with its high precision, high efficiency, and multi-material joining capabilities, has become an indispensable core technology in modern automotive production. It can achieve high-quality and highly consistent welding operations at high speeds, significantly enhancing production pace and product consistency, and is widely used in various automated production lines. Meanwhile, the rapid development of electric vehicles has further driven the demand for high-performance laser welding equipment, particularly in key areas such as battery module assembly, thermal management systems, and the welding of lightweight structural components.

Figure 4. Laser welding, with its high precision, high efficiency and multi-material joining capabilities, has become an indispensable core technology in modern automotive production.

Medical industry applications in the laser welding machine market

The medical field is becoming the fastest-growing application segment in the laser welding machine market, with an expected average annual growth rate of approximately 8% from 2024 to 2029. This growth is mainly driven by the strong demand for high-precision and pollution-free welding technologies in the manufacturing of medical devices, including pacemakers, hearing aids, and surgical instruments. With the widespread adoption of minimally invasive surgical techniques, the demand for smaller and more complex medical devices is constantly increasing. Laser welding, with its advantages of non-contact processing, small heat-affected zone, and the ability to achieve sterile sealed joints, has become an ideal solution in this field. In recent years, continuous innovations in micro-laser welding technology have not only enhanced the feasibility of manufacturing ultra-small medical devices but also effectively met the high standards of product reliability and quality control in the medical industry.

Figure 5. The medical field is becoming the fastest-growing application segment in the laser welding machine market. (Image source: Internet)

Other application market segments

Apart from the automotive and medical fields, laser welding machines are also widely used in multiple important industries such as electronics, jewelry, tool and mold manufacturing. In the electronics industry, laser welding technology is widely applied in high-precision processing links such as the manufacturing of consumer electronic products, semiconductor packaging and microelectronic component assembly. The jewelry industry uses laser welding to achieve precise welding of precious metal jewelry and fine processing of complex structures, significantly improving the quality of craftsmanship and design flexibility. In the field of tool and mold manufacturing, laser welding technology is relied upon to precisely repair and optimize the structure of high-value molds, effectively extending their service life. Additionally, in the aerospace, energy equipment and general manufacturing sectors, laser welding, with its ability to adapt to complex material combinations and special connection requirements, demonstrates strong market potential and wide technical adaptability.

Figure 6. Laser welding demonstrates multiple advantages in the manufacturing of aviation components, effectively reducing welding deformation and residual stress, and enhancing the strength and fatigue life of the products.

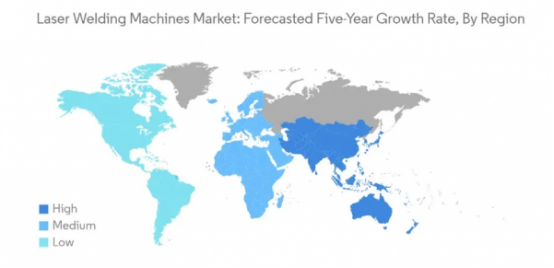

Analysis of the regional distribution of the laser welding machine market

The North American laser welding machine market

The North American laser welding machine market is expected to account for approximately 21% of the global market share in 2024, mainly due to the rapid expansion of electric vehicle battery manufacturing capacity. The region's strategic focus is on building a broad battery manufacturing infrastructure, especially in key areas such as Georgia, Kentucky, and Michigan, which has greatly driven the demand for advanced laser welding technology. It is estimated that by 2030, the electric vehicle battery production capacity in these states will reach 97 to 136 gigawatt-hours, putting forward higher requirements for efficient welding solutions. At the same time, the development of the precision manufacturing industry has also contributed to market growth, with enterprises expanding their business scope to cover medical device components, metal processing, and hydraulic testing, among others. The region's emphasis on technological innovation is reflected in the continuous introduction of new laser processing systems by major market players, specifically tailored for electric vehicle manufacturing. Characterized by high-quality welding, high-capacity manufacturing, and competitive cost structures, the North American market has become a core strategic area for laser welding equipment enterprises.

Figure 7. Laser Welding Machine Market: Future Five-Year Growth Rate Forecast by Region (Photo Credit: Mordor Intelligence)

The European laser welding machine market

The European laser welding machine market has demonstrated a strong growth momentum, with an estimated growth rate of approximately 27% from 2019 to 2024, and has become a key pillar of advanced manufacturing in the region. Germany, as a globally renowned center for the research and development and manufacturing of laser welding machines, is home to major players such as VISION, EMAG, and Trumpf. The automotive industry accounts for more than half of the total demand for laser welding machines in Europe, with major manufacturers located in Germany, France, and Italy. With Europe's increasing emphasis on the production of electric vehicle batteries, battery production capacity has expanded rapidly, presenting broad market opportunities. This market is characterized by continuous technological innovation, particularly in the field of laser transmission welding of plastic components in advanced driver assistance systems.

The laser welding machine market in the Asia-Pacific region

The laser welding machine market in the Asia-Pacific region is expected to witness significant growth, with a compound annual growth rate of approximately 37% from 2024 to 2029, making it the fastest-growing region globally. China, as the leading market in the region, boasts a well-established and robust manufacturing ecosystem, with representative enterprises such as HAN's Laser, Huagong Technology, and Penta Laser. The region's advanced electronics manufacturing industry further solidifies its market position, with laser welding technology playing a crucial role in the production of electronic devices such as smartphones, tablets, and laptops. As anti-dumping policies and quality standards are gradually implemented, the market is undergoing profound transformation, particularly in countries like India, which are actively promoting the establishment of a fair competitive industry environment. The manufacturing of electric vehicle batteries has become a major growth driver, with China significantly expanding its battery production capacity, while countries like Japan and India are also accelerating their local manufacturing layouts. With cost advantages, a rich pool of skilled labor, and a favorable investment environment, the Asia-Pacific region continues to attract global manufacturers, including the rapid development of local laser welding machine enterprises in India.

The laser welding machine market in Latin America

The laser welding machine market in Latin America is undergoing a profound transformation, mainly driven by the rapid expansion of the automotive and electronics manufacturing industries in the region. As the largest car assembly country in South America, Brazil leads the market development, followed by Argentina and Colombia, while Chile has become one of the fastest-growing and most promising automotive markets in the region. Thanks to the entry of large multinational enterprises and a series of supportive policies introduced by governments in various countries, especially in Brazil, the electronics industry shows great growth potential. The strategic layout of the region for electric vehicle battery manufacturing has brought new development opportunities. Argentina and other countries have established the first lithium battery factories in Latin America. The development of the market is also attributed to the increase in research and development investment, the improvement of industrial automation levels, and the continuous emergence of skilled labor. The continuous modernization of manufacturing facilities and the wide application of advanced technologies are reshaping the regional market landscape and attracting more and more laser welding machine suppliers to pay attention to and enter the market.

The laser welding machine market in the Middle East and Africa

Driven by the rapid development in the manufacturing of electric vehicle batteries and automotive production, the laser welding machine market in the Middle East and Africa is undergoing profound changes. The region is actively promoting strategic transformation, with a focus on increasing investment in manufacturing infrastructure. For instance, Morocco is building a super factory for electric vehicle batteries, while Turkey is continuously expanding its battery manufacturing capacity. The Gulf Cooperation Council (GCC) countries, particularly the United Arab Emirates and Saudi Arabia, are experiencing strong growth in the automotive industry, with a growing focus on electric and hybrid vehicles. Prominent features of the market include the continuous improvement of industrial automation levels, increasing investment in advanced manufacturing technologies, and the continuous construction of new production facilities. The region is committed to diversifying its industrial base, and with the government's preferential policies and support measures, it has created numerous new opportunities for laser welding machine manufacturers. At the same time, the continuous entry of international manufacturers and the widespread adoption of advanced manufacturing technologies across various industries have further driven the steady development of the market.

Lead the Intelligent Welding Revolution: Greater Bay Area AI + Laser Welding Summit

Lead the Intelligent Welding Revolution: Greater Bay Area AI + Laser Welding Summit Splashing 200 Million Yuan! Three Industry Giants Boost Investment in the Laser Track

Splashing 200 Million Yuan! Three Industry Giants Boost Investment in the Laser Track Two New Companies Established! Han's Ecosystem Further Expands

Two New Companies Established! Han's Ecosystem Further Expands Multi-Sector Flourish! Five Major Laser Parks Rise Rapidly

Multi-Sector Flourish! Five Major Laser Parks Rise Rapidly The Grand Finale is Here! Three Major Laser Headquarters Base Projects Topped Out

The Grand Finale is Here! Three Major Laser Headquarters Base Projects Topped Out

Intelligent Scientific Systems: Leading Domestic Ultrafast Imaging, Redefining Visual Perception

Intelligent Scientific Systems: Leading Domestic Ultrafast Imaging, Redefining Visual Perception From Rural Girl to Laser Helmsman: Fu Chunhua's Light-Chasing Journey

From Rural Girl to Laser Helmsman: Fu Chunhua's Light-Chasing Journey Scanner Optics: Galvanometer Tech Leader

Scanner Optics: Galvanometer Tech Leader The "Light Chasers" in the Deep Ultraviolet World

The "Light Chasers" in the Deep Ultraviolet World Shi Lei (Hipa Tech): Focus on Domestic Substitution, Future Layout in High-End Laser Micromachining

more>>

Shi Lei (Hipa Tech): Focus on Domestic Substitution, Future Layout in High-End Laser Micromachining

more>>