3D Print Deep Rpt: Consumer-grade 3D Print Content Drives Demand, CAGR >18%

source:Weber Industry Think Tank

keywords:

Time:2025-09-05

Source: Weber Industry Think Tank 1st September 2025

I. The consumer 3D printing market has vast space and its demand is accelerating. The blue ocean market of consumer 3D printing is expanding rapidly, and Chinese manufacturers have significant competitive advantages in the global consumer market.

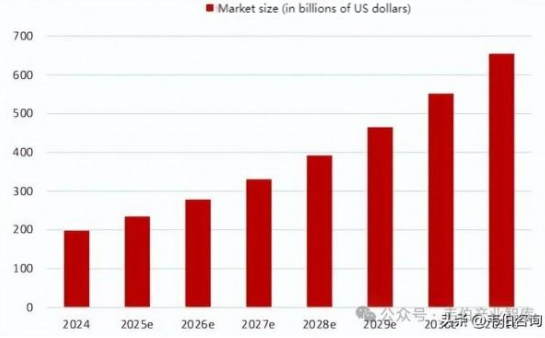

The consumer market has entered a stage of explosive growth. It is estimated to reach approximately 19.8 billion US dollars in 2024 and is expected to reach 65.4 billion US dollars by 2031, with a compound annual growth rate of 18.6%.

North America currently holds the major share of the consumer market, while the Asia-Pacific region is the fastest-growing area driven by technology and applications.

In 2024, Chinese brands accounted for 96% of the global market share of entry-level equipment. Leading companies such as Bambu Lab, Creality, and Anycubic were the main contributors to the shipments.

The consumer-grade 3D printing industry is entering a stage of rapid growth, with multiple factors driving the release of demand:

①Cost reduction: The decline in consumable and equipment costs has driven the popularization of consumer-grade printers and their gradual expansion into new markets.

② Usability improvement: The printing speed has been increased, the precision has been broken through, and the yield rate has been raised to 70%. The usability of products catering to the needs of makers has been significantly enhanced. This not only makes the equipment "easy to use" and "loved by consumers", but also enables non-professional users to get started easily, thereby greatly expanding the downstream application scenarios.

③ Scene expansion: Diverse scenarios such as education, family, cultural and creative industries, jewelry, and healthcare are accelerating the release of printing demands.

④ Going global: Overseas demand is strong, user acceptance is high, and the willingness to pay is strong.

II. Consumer-grade 3D printing content drives demand, with extensive downstream applications

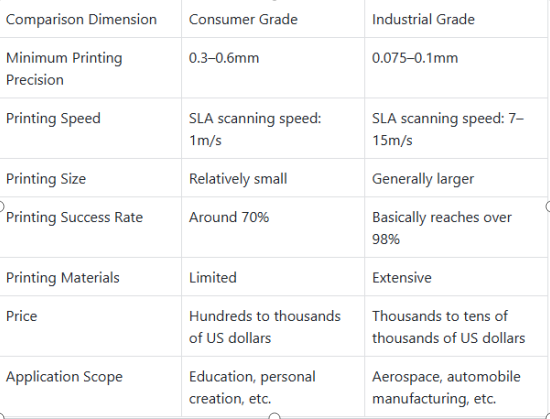

3D printing (additive manufacturing) is a manufacturing technology that forms three-dimensional objects by layering materials. It is widely used in both industrial manufacturing and personalized consumer sectors. Classified by application scenarios, it can be divided into industrial-grade and consumer-grade categories:

1. Industrial-grade equipment

Mainly targeting high-precision scenarios such as aerospace, molds, and medical fields, it relies on metal and ceramic materials, with high costs (ranging from several thousand to tens of thousands of US dollars), but offers excellent precision and structural performance, making it suitable for large-scale industrial production.

2. Consumer-grade devices

Consumer-grade 3D printing, also known as desktop 3D printing, is targeted at a diverse range of downstream scenarios such as entertainment, education, home, and design. Open-source models, software ecosystems, and community sharing have reduced the learning cost of 3D printing, stimulating consumers' interest and purchase intention.

From a technological perspective, consumer-grade 3D printing mainly focuses on non-metallic processes such as FDM (Fused Deposition Modeling) and SLA (Stereolithography), with costs compressed to the hundreds of dollars range. In terms of materials, commonly used materials include PLA (Polylactic Acid), ABS (Acrylonitrile Butadiene Styrene), and PETG (Polyethylene Terephthalate Glycol), which feature low entry barriers, fast printing speeds, and easy repurchase. They are gradually expanding from display-oriented to functional light manufacturing demands.

Ⅲ. The market space is vast, with an annual compound growth rate exceeding 18%.

The global consumer 3D printing market is entering a period of explosive growth.

According to PrecisionBusinessInsights, the global consumer 3D printing market size is expected to be approximately 19.8 billion US dollars in 2024, and it is projected to maintain a compound annual growth rate of 18.6% from 2024 to 2031, reaching a market size of 65.4 billion US dollars by 2031. The global consumer 3D printing market is showing a rapid expansion trend with broad market prospects.

Overseas demand is strong, user acceptance is high, and the willingness to pay is strong.

In the first half of 2024, the United States accounted for 37.2% (680,000 units) of China's 3D printer exports, maintaining its position as the top market. Germany was the second largest export market, with a share of 19.7% (360,000 units).

The "what you think is what you get" feature of 3D printers aligns well with the overseas customers' preference for innovation and individualized expression. Overseas users are willing to pay for the innovative experience and practical value brought by consumer-grade 3D printing technology.

IV. Enhancement of Consumer-level Usability Facilitates Mass Adoption

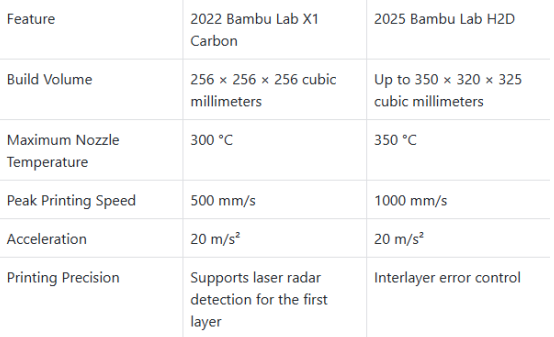

Consumer-level 3D printing has made breakthroughs in usability, mainly reflected in the overall improvement of efficiency, precision, and print success rate.

Printing speed has been enhanced, aiming for what you see is what you get. The stable printing speed has exceeded 600mm/s, marking a significant improvement over previous models. Taking the Topzhu H2D series as an example, its peak speed reaches 1000mm/s, and it supports full-process anomaly identification and feedback adjustment.

Precision breakthroughs enhance user experience. According to the product parameters disclosed by FlashForge Technology, the layer thickness of its 3D printing has been optimized from 16 μm to 15 μm. Tuozhu's H2D has also achieved a height accuracy of ±0.1 mm in the Z direction. The improvement in precision has expanded the application of consumer-grade 3D printing from simple prototype making to areas with higher detail requirements such as figurines and precision parts.

Yield improvement, addressing user pain points. The new generation of equipment is equipped with functions such as first-layer detection by LiDAR and automatic leveling, significantly enhancing print quality and print success rate. Currently, the success rate for consumer-grade is approximately 70%.

V. Consumer-grade 3D printing equipment accelerates overseas expansion, and global competitiveness continues to enhance

1. Consumer-grade 3D printing equipment accelerates overseas expansion

In recent years, the export of consumer-grade 3D printing equipment from China has accelerated significantly, with both the volume and value of exports rising. China has become a core supplier in the global market. In 2024, China exported a total of 3.778 million 3D printing machines, with an export value of 8.163 billion yuan, representing a growth of 32.75%.

After entering 2025, the growth momentum has further accelerated. In the first four months alone, the export of consumer-grade equipment reached 1.399 million units, achieving an export value of 2.73 billion yuan, accounting for as high as 94% of the total 3D printer export value.

2. The global competitiveness of consumer-grade 3D printing equipment continues to strengthen.

According to the ConTEXT report, in 2024, approximately 96% of the global shipments of entry-level (consumer-grade) 3D printers will come from Chinese manufacturers, mainly due to the strong performance of leading domestic producers such as Bambu Lab, Creality, Anycubic, and SmartMaker.

Chinese manufacturers' competitive edge in the global consumer market is increasingly solidified, and they are continuously expanding their influence and market share overseas.

Bambu Lab Technology is experiencing explosive growth and is expected to exceed 5.5 billion yuan in 2024, rapidly emerging as the industry leader. Creality, relying on its mature supply chain and overseas channels, is projected to achieve a revenue of 2.3 billion yuan in 2024, ranking second in the industry and maintaining steady growth. The revenues of Anycubic and ELEGOO are also steadily increasing.

Lead the Intelligent Welding Revolution: Greater Bay Area AI + Laser Welding Summit

Lead the Intelligent Welding Revolution: Greater Bay Area AI + Laser Welding Summit Splashing 200 Million Yuan! Three Industry Giants Boost Investment in the Laser Track

Splashing 200 Million Yuan! Three Industry Giants Boost Investment in the Laser Track Two New Companies Established! Han's Ecosystem Further Expands

Two New Companies Established! Han's Ecosystem Further Expands Multi-Sector Flourish! Five Major Laser Parks Rise Rapidly

Multi-Sector Flourish! Five Major Laser Parks Rise Rapidly The Grand Finale is Here! Three Major Laser Headquarters Base Projects Topped Out

The Grand Finale is Here! Three Major Laser Headquarters Base Projects Topped Out

Intelligent Scientific Systems: Leading Domestic Ultrafast Imaging, Redefining Visual Perception

Intelligent Scientific Systems: Leading Domestic Ultrafast Imaging, Redefining Visual Perception From Rural Girl to Laser Helmsman: Fu Chunhua's Light-Chasing Journey

From Rural Girl to Laser Helmsman: Fu Chunhua's Light-Chasing Journey Scanner Optics: Galvanometer Tech Leader

Scanner Optics: Galvanometer Tech Leader The "Light Chasers" in the Deep Ultraviolet World

The "Light Chasers" in the Deep Ultraviolet World Shi Lei (Hipa Tech): Focus on Domestic Substitution, Future Layout in High-End Laser Micromachining

more>>

Shi Lei (Hipa Tech): Focus on Domestic Substitution, Future Layout in High-End Laser Micromachining

more>>