IPG Photonics reports record first quarter for 2018

source:Laser Focus World

release:Nick

keywords: High-power fiber laser IPG Photonics

Time:2018-05-08

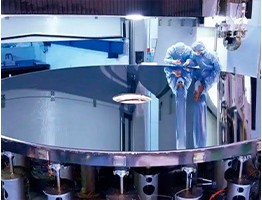

High-power fiber laser maker IPG Photonics (Oxford, MA) reported financial results for the first quarter ended March 31, 2018.

"The momentum that carried IPG through an outstanding year in 2017 continued in the first quarter of 2018," says Valentin Gapontsev, IPG Photonics' CEO. "We delivered record first-quarter revenue and net income, driven by the rapid adoption of IPG's high-power products within our largest market segments and geographies."

First-quarter revenue of $359.9 million increased 26% year over year. Materials processing sales increased 28% year over year and accounted for approximately 94% of total sales, driven by strength in cutting and 3D printing applications. Sales to other markets decreased 5% year over year. High-power continuous-wave (CW) laser sales increased 37% year over year, representing 64% of total revenue, with even stronger growth in sales of ultra-high power CW lasers with power levels of 6 kW and above. By region, sales increased 29% in China and Europe, 39% in Japan, and 3% in the United States, on a year-over-year basis.

Earnings per diluted share (EPS) of $1.93 increased 40% year over year. Foreign exchange gains benefited EPS by $0.07. The effective tax rate in the quarter was 25%. The company's tax rate benefited from the lower U.S. Federal tax rate of 21%, while certain discrete items, including excess tax benefits related to equity compensation, were offset by additional taxes accrued for Global Intangible Low Taxed Income (GILTI) net of Foreign Derived Intangible Income (FDII) deduction benefits.

During the first quarter, the company generated $99.7 million in cash from operations and used $39.1 million to finance capital expenditures. The company ended the quarter with $1.18 billion in cash and cash equivalents and short-term investments, representing an increase of $59.8 million from December 31, 2017.

"During the first quarter of 2018, we achieved the highest level of quarterly bookings in the company's history," Gapontsev says. "As a result, our first quarter book-to-bill ratio was above 1, positioning us to deliver strong results in the second quarter as well."

For the second quarter of 2018, the company expects revenue of $400 to $430 million, representing growth of 8% to 15% year over year. The company expects the second-quarter tax rate to be approximately 26% excluding effects relating to equity grants, and anticipates delivering EPS in the range of $2.05 to $2.35, representing growth in the range of 7% to 23% year over year, with 53.7 million basic common shares outstanding and 55.2 million diluted common shares outstanding. At this time, the company is not updating its 2018 annual guidance.

GBA High-Standard Summit Addresses Four AI+Laser Welding Core Propositions

GBA High-Standard Summit Addresses Four AI+Laser Welding Core Propositions Three Co-founders of a Leading Domestic LiDAR Maker Co-found a Robotics Firm

Three Co-founders of a Leading Domestic LiDAR Maker Co-found a Robotics Firm High-Efficiency Conversion Feeds R&D! Optoelectronic HOPE Model Builds a New Industrial Engine

High-Efficiency Conversion Feeds R&D! Optoelectronic HOPE Model Builds a New Industrial Engine Four-Meeting Linkage: China Laser CEO Shenzhen Night Shines Bright

Four-Meeting Linkage: China Laser CEO Shenzhen Night Shines Bright Lead the Intelligent Welding Revolution: Greater Bay Area AI + Laser Welding Summit

Lead the Intelligent Welding Revolution: Greater Bay Area AI + Laser Welding Summit

Father of Shenguang Facility: Building Three Generations of National Strategic Equipment

Father of Shenguang Facility: Building Three Generations of National Strategic Equipment LASERVALL's Li Mengmeng: A Leader in Laser Solder Ball Welding, Deep in Automated Niche Sectors

LASERVALL's Li Mengmeng: A Leader in Laser Solder Ball Welding, Deep in Automated Niche Sectors Intelligent Scientific Systems: Leading Domestic Ultrafast Imaging, Redefining Visual Perception

Intelligent Scientific Systems: Leading Domestic Ultrafast Imaging, Redefining Visual Perception From Rural Girl to Laser Helmsman: Fu Chunhua's Light-Chasing Journey

From Rural Girl to Laser Helmsman: Fu Chunhua's Light-Chasing Journey Scanner Optics: Galvanometer Tech Leader

more>>

Scanner Optics: Galvanometer Tech Leader

more>>