Will materials processing drive global laser markets again in 2018?

材料加工会再次推动2018全球激光市场吗?

In the last blog, we covered how a few of the laser segments that did great in 2017 were performing so far in 2018. One was vertical-cavity surface-emitting lasers (VCSEL) which gained popularity when Apple incorporated these lasers into its Face ID system, but to date, other companies have been slow to master the technology and include them in their phones, but Apple has stayed committed to Face ID. Apple’s use of OLED screens in the iPhone X also initially drove increased demand for excimer lasers in 2017. These lasers, which Coherent produces for the annealing of OLED screens, gained a very high profile in 2017, but since then, the high cost of the OLED screens has scared off Chinese phone manufacturers, and rumor is, even Apple might be retreating from OLED screens in hopes of containing costs. (Another rumor says Apple will use OLED screens for even more new iPhones this year, so go figure.)

在上一篇文章,我们谈到了一些在2017表现惊艳的部分激光在2018年目前的市场表现。一个是在被苹果引入其Face ID系统而大受关注的垂直腔面发射激光器(VCSEL),虽然到目前为止其他公司也慢慢掌握了这项技术并将其应用到他们的手机中,但苹果是铁了心要发展它的Face ID。同样,苹果去年一开始将OLED引入iPhone X时也提升准分子激光器的需求。这些由相干公司生产,用于OLED屏幕退火的激光器在2017年也一度十分引人注目,但从那以后,OLED 屏幕高昂的成本劝退了中国的手机制造商们,而且据坊间传闻,苹果为了控制成本或许也将弃用OLED 屏幕。(另一个传言称苹果今年将用OLED 屏幕生产更多的新款iPhone,所以这些消息看看就行了。)

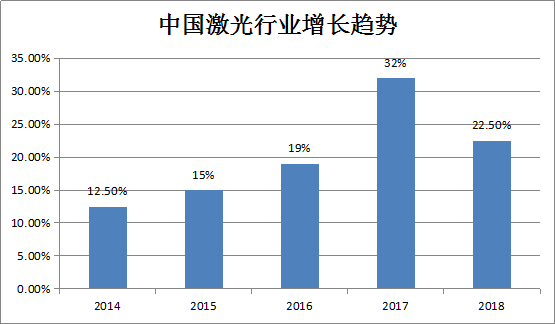

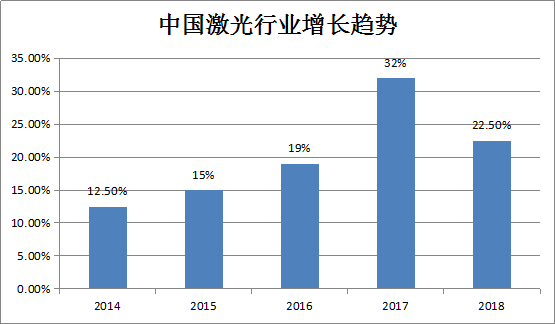

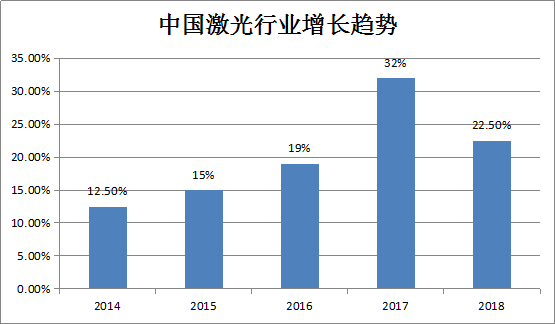

A third segment that performed incredibly well in 2017 was materials processing, specifically high-powered lasers for materials processing produced by companies such as nLight, IPG, Lumentum, Wuhan Raycus, and Coherent. This segment of lasers will be the topic of what is being discussed today. For reference, in 2017, total revenue for the macro (1KW+) materials processing laser segment was $2.30 billion dollars, which was a 54% increase over 2016 laser revenue in the same segment. Keep in mind, a typical yearly increase in high-power materials processing averages about 5%-7% yearly, so 2017 was an exceptional year for this segment, but the question is, can this growth continue in 2018?

在2017年表现出色的激光市场的第三个部分是材料加工,特别是由恩耐、IPG、Lumentum、锐科激光、以及相干公司生产的用于材料加工的高功率激光器。作为参考,2017年宏观材料加工激光器(1KW+)的总体营收是23亿美元,相比2016年增长了54%。记住,高功率材料加工一般的年增长的平均水平在5% - 7%每年,因此2017的增长是不可思议的,但值得疑问的是,2018年还能保持这种增长水平吗?

If you look at where the growth in KW+ lasers we experienced in 2017, most of it came from Asia (especially China) and Europe, with North America being relatively flat during the period. In Europe and Asia, the majority of laser gains in KW+ laser revenue can be attributed to three factors; 1) increases in laser usage due to laser tools displacing non-laser forms of manufacturing, 2) increases in large manufacturing projects requiring laser tools, and finally, 3) a fear of future laser price increases due to trade restrictions and tariffs. Which of these three factors that had the greatest influence has been the cause for debate, but without question, all played some part. Laser tools are rapidly replacing non-laser tools, a good economy is fueling many projects, and the fear of trade restrictions causing pre-emptive buying.

如果你看一下万瓦级激光器在2017年增长的地方,会发现绝大多数增长来自亚洲(特别是中国)和欧洲,而北美只是相对增长。在欧洲和亚洲,万瓦级激光器的营收可能得益于三个因素:1)由于非激光模式的生产被激光设备所取代,导致激光器的使用量大幅提高;2)大型制造项目的增加需要更多的激光设备;3)最后,由于担忧因贸易限制和关税导致的未来激光器价格上涨的购买。以上这三个的因素是否对万瓦级激光器销售增长影响最大一直存在争议,但毫无疑问的是,它们都在一定程度上有着各自的影响。激光加工正在迅速地取代非激光加工,一个运行良好的经济肯定会推动很多工业项目,并且对贸易限制的担心会导致先发制人的购买。

Because the threat of tariffs and trade restrictions may have played a part in KW+ laser growth in 2017, let’s take a look at what has actually materialized in 2018. On June 15th, President Trump approved a 25% tariff on approximately $50 billion worth of Chinese imports including laser machine tools, optical products, and lasers other than laser diodes. In response, China has published its own list of the U.S. products it plans to place either a 15% tariff or 25% tariff on, and this list is mainly composed of fruits, meats, and types of steel tubing, but not lasers.

由于关税的威胁和贸易限制有可能对2017年万瓦级激光器增长产生了关键影响,那让我们来看一看2018年实际出现的情况。6月15日,川普总统批准了对价值约为500亿美元的中国进口商品征收25%的关税,其中包括激光机床、光学产品以及除二极管激光器以外的激光器。作为回击,中国政府公布了其计划征收15%或25%关税的美国进口产品目录,其中主要包括了水果、肉类、数种钢管等,但唯独没有激光器。

U.S. laser imports from China are generally limited to low-power laser workstations used for marking applications. U.S. laser manufacturers also make similar marking stations, but at higher prices, and some U.S. manufacturers have already exited this business because of Chinese low-priced competition. As for exports of laser from the U.S., more U.S. high-power lasers are exported to China than any other country, but it appears, at least currently, Chinese tariffs will not apply to lasers. In fact, if the Chinese were to impose tariffs on U.S. laser imports, this would likely negatively impact Chinese companies more than U.S. laser companies, because in many cases, U.S. lasers are the only models available at the highest power levels. So to summarize, at least for the time-being, it doesn’t look like tariffs between China and the U.S. are going to have much effect on laser imports or laser exports, but this could change at anytime.

美国从中国进口的激光通常仅限于用于打标应用的低功率激光工作站。美国激光制造商也生产类似的打标工作站,但是价格更高,而且因为中国同行的低价竞争,部分美国打标机制造商早已退出了市场。至于从美国出口的激光器,中国是世界上进口得最多的,但是至少照目前的情况来看,中国的关税不会加到激光器身上。事实上,假如中国政府决定对进口美国的激光器施加关税,这很有可能是一发“七伤拳”一一“七分伤己,三分伤人”。因为在很多情况下,美国的激光器是唯一可用于最高功率水平的激光器。所以总的来说,至少暂时,中美之间不太会在激光的关税问题上做太多文章,然而情况也是随时可能变化的。

Finally, taking all of the above in-mind, how are high-power laser revenues looking in 2018 compared to 2017 levels? They are growing, but at a much slower growth-rate than what we saw in 2017. This really shouldn’t be surprising, because the rate of growth we saw in 2017 was just not sustainable over longer periods. Currently high-power laser revenue growth looks to be around an annual growth-rate of 12% – 15% for 2018, certainly above average, but much below what we witnessed in 2017. However, the year is not even half over yet, so it is still quite early. After an incredible 2017, my guess is that we might see 2018 high-power laser revenues continue to slow a bit from current levels, still putting 2018 above-average overall. A few negative indicators are being displayed, but nothing to stop the jubilant times of 2017 from spilling over a bit in 2018. Overall, we expect 2018 to be a good year overall, just quite not at the growth-rates we saw in 2017.

最后,把以上的全部纳入考量,对比2017年,今年高功率激光器营收会如何?增长是肯定的,但是会以一个比去年慢得多的速度增长。这真的丝毫不让人意外,因为2017年的增长是不可能在长时间里持续的。目前高功率激光器的营收增长率似乎在2018年的年增长率12%-15%左右,肯定高于平均水平,但远低于我们在2017年目睹的水平。然而,今年才刚过半,因此下结论还为时尚早。经过疯狂增长的2017后,我的猜测是我们或许会看到2018高功率激光器营收继续从目前的水平略微放缓,但仍然使2018年的总体高于平均水平。尽管当前有一些负面消息在影响着增长,但什么也不能阻止2017的欢腾时光向2018年溢出一些。总体而言,我们预计2018年将成为一个好年头,只是2017年的增长今年怕是看不到了。

![]()

![]()

相关文章

相关文章 网友点评

网友点评

热门资讯

热门资讯 精彩导读

精彩导读 关注我们

关注我们