Digitalization has become an important upgrade direction for lidar

source:Shanghai Securities News

keywords:

Time:2025-09-06

Source: Shanghai Securities News 3rd July 2025

Driven by the wave of "autonomous driving equality" this year, the lidar track has seen the emergence of a strong "new entrant".

According to data from Gaogong Intelligent Automotive Industry Research Institute, from January to May this year, the pre-installed volume of lidars in passenger vehicles in the Chinese market reached 789,200 units, a year-on-year increase of 83.45%. Among them, Huawei jumped to the top in shipment volume thanks to large-scale pre-installation in multiple models such as Wenjie, Zhijie, and AITO.

Several interviewees stated that Huawei's inclusion in the rankings this time was not an "active effort" but rather a "by-product" of selling its ADS (Advanced Driving System) intelligent assisted driving systems. However, the driving effect of the popular models it cooperates with is continuously increasing the penetration rate of lidars in the mainstream market. With the accelerated implementation of L3-level autonomous driving, digitalization has become an important upgrade direction for lidars.

Popular Models Pave the Way for Products

"Huawei's 'ranking' is actually not surprising," a third-party institution told Shanghai Securities News.

Yole Group's recently released *2025 Global Automotive Lidar Market Report* shows that the global automotive lidar market saw explosive growth in 2024. Although Hesai and RoboSense still accounted for half of the total market share, Huawei is accelerating its breakthrough, with its overall share rising from 6% in 2023 to 19% in 2024; in the passenger vehicle sector, it jumped from 8% to 24%, ranking third globally, following RoboSense and Hesai.

"The rapid increase in Huawei's pre-installed lidar volume in the first five months of this year is mainly due to the strong drive of popular models such as Wenjie," the aforementioned institution source said.

Currently, Huawei has collaborated with over a dozen domestic and foreign automakers including Seres, Chery, AITO, and Audi. Many of these models are equipped with Huawei's ADS intelligent assisted driving system and lidars. For example, the 2025 Wenjie M9 is equipped with 1 192-line lidar and 3 high-precision solid-state lidars; the new Zhijie S7 Max and Ultra are built with 27 perception hardware including lidars.

While expanding its cooperation network, Huawei is also accelerating its product layout. In April this year, Huawei released the Qiankun High-Level Intelligent Driving Assistance System ADS 4.0, and simultaneously launched the mass-produced high-precision solid-state lidar. Its ADS 4.0 is further divided into ADS SE (basic version), ADS Pro (enhanced version), ADS Max (ultra-advanced version), and ADS Ultra (flagship version). Except for the ADS SE basic version, the other three plans are all equipped with lidars.

This also aligns with the current dual evolution path of the lidar market: "sinking + upward exploration". On one hand, BYD, Geely, Leapmotor, Chery, etc., have brought lidars down to 100,000-yuan-class models, breaking the inherent impression of them as "exclusive to high-end models"; on the other hand, L3-level autonomous driving is accelerating its implementation, driving the number of lidars per vehicle in some models to 3 to 4.

"Currently, the growth in demand for lidars mainly comes from two aspects: first, the start of autonomous driving equality, accelerating the sinking of lidars; second, the accelerated implementation of L3-level autonomous driving, with the configuration level of lidars sinking, leading to two-way accelerated penetration of demand," summarized Yang Zhong, chief analyst at Huafu Semiconductor, to the reporter.

"Veteran Players" Driven by Both Technology and Mass Production

Facing new market forces, leading lidar companies are accelerating forward with stronger product strength and scale capabilities.

Hardware, mass production, and verification are the three core barriers for automotive lidars. In Yang Zhong's view, only manufacturers with self-developed chip capabilities, precision manufacturing systems, and automotive-grade ecological resources can thrive in the industry.

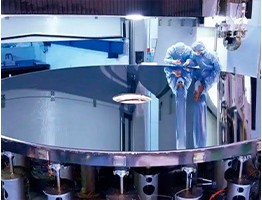

On June 16, RoboSense officially delivered its 1 millionth automotive lidar, becoming the world's first technology company to reach this milestone. By the end of the first quarter of this year, the company had obtained mass production fixed-point orders for over 100 models from 30 automobile OEMs and tier-1 suppliers, among which 38 models from 12 customers have already started mass production. Technologically, RoboSense advocates "fully entering the digital era", with digital lidars represented by its self-developed SPAD-SoC driving product upgrades.

Another leading company, Hesai, achieved a total delivery volume of 195,800 units in the first quarter of this year, a year-on-year increase of 231.3%, with a net loss of 17.5 million yuan, a year-on-year narrowing of 84%. Fan Peng, CFO of Hesai, stated in the earnings conference call that the company is steadily moving towards its full-year profit target. Currently, Hesai has reached mass production fixed-point cooperation for over 120 models with 22 domestic and foreign automakers including BYD, Li Auto, and Xiaomi.

On the product front, Hesai is driving cost reduction through technological iteration. Its fourth-generation SoC chip integrates laser driving and signal processing modules, further reducing power consumption and mass production costs; the ATX radar newly delivered in the first quarter has higher point cloud density and longer detection distance, with the price dropping to $200.

"The cost reduction of lidars and large-scale popularization form a positive cycle, promoting their penetration from high-end models to the mainstream market," Yang Zhong said. "As the price of lidar products drops rapidly, the configuration rate is expected to increase significantly, driving the industry chain into a virtuous development cycle of 'technological cost reduction - scale expansion - profit realization'."

Digitalization Accelerates Lidar's Cross-Industry Breakthrough

"Huawei's high pre-installed shipment volume has, to a certain extent, promoted market awareness and accelerated consumers' acceptance of lidars," an industry insider related to intelligent driving said.

A consensus among multiple interviewees is: with the accelerated implementation of L3-level autonomous driving, vehicles face higher requirements in terms of safety, redundancy design, and fault backup, making high-performance lidars significantly more important. Technically, the number of lines of a lidar determines its performance ceiling, and the digital architecture has significant advantages in expanding the number of lines and improving perception accuracy of lidars, helping to more accurately perceive road conditions and enhance driving safety.

In January this year, RoboSense released the world's first "1000-line" ultra-long-range digital lidar EM4, which can achieve a maximum ranging capability of 600 meters in 1080P mode; in April, RoboSense further released the 192-line digital lidar EMX. Since the product launch, it has accumulated 17 model fixed-points from 5 global automakers.

Beyond the intelligent driving field, digital lidars are accelerating their entry into emerging scenarios.

"Except for the automotive field, other fields have increasing demand for perception due to the rise of robotics technology. Currently, lawn-mowing robots and unmanned delivery are booming," Xie Tiandi, marketing director of RoboSense, told Shanghai Securities News.

In May this year, RoboSense reached a strategic cooperation with Kuma Technology, planning to deliver 1.2 million automotive-grade all-solid-state lidars within three years for developing the perception system of high-end intelligent lawn-mowing robots. In the field of unmanned delivery, RoboSense has also cooperated with over 90% of industry-leading customers such as Neolix, White Rhino, and Coco Robotics.

GBA High-Standard Summit Addresses Four AI+Laser Welding Core Propositions

GBA High-Standard Summit Addresses Four AI+Laser Welding Core Propositions Three Co-founders of a Leading Domestic LiDAR Maker Co-found a Robotics Firm

Three Co-founders of a Leading Domestic LiDAR Maker Co-found a Robotics Firm High-Efficiency Conversion Feeds R&D! Optoelectronic HOPE Model Builds a New Industrial Engine

High-Efficiency Conversion Feeds R&D! Optoelectronic HOPE Model Builds a New Industrial Engine Four-Meeting Linkage: China Laser CEO Shenzhen Night Shines Bright

Four-Meeting Linkage: China Laser CEO Shenzhen Night Shines Bright Lead the Intelligent Welding Revolution: Greater Bay Area AI + Laser Welding Summit

Lead the Intelligent Welding Revolution: Greater Bay Area AI + Laser Welding Summit

Father of Shenguang Facility: Building Three Generations of National Strategic Equipment

Father of Shenguang Facility: Building Three Generations of National Strategic Equipment LASERVALL's Li Mengmeng: A Leader in Laser Solder Ball Welding, Deep in Automated Niche Sectors

LASERVALL's Li Mengmeng: A Leader in Laser Solder Ball Welding, Deep in Automated Niche Sectors Intelligent Scientific Systems: Leading Domestic Ultrafast Imaging, Redefining Visual Perception

Intelligent Scientific Systems: Leading Domestic Ultrafast Imaging, Redefining Visual Perception From Rural Girl to Laser Helmsman: Fu Chunhua's Light-Chasing Journey

From Rural Girl to Laser Helmsman: Fu Chunhua's Light-Chasing Journey Scanner Optics: Galvanometer Tech Leader

more>>

Scanner Optics: Galvanometer Tech Leader

more>>